Data Availability

The firm uses proprietary software tools and multiple sources of information in order to ensure that the data received is comprehensive, accurate and timely.

We process and deliver additional derived data points according to specific criteria using bespoke algorithms to highlight sources of alpha within the data.

Through our quantitative data service clients receive complete updates of 'Investment Grade' data including contextual and derived items according to their needs; including intra-day and point-in-time options via SFTP, API or Snowflake.

For more information contact us

Smart Insider Quantitative Data

We remove the noise

Valuable Insight

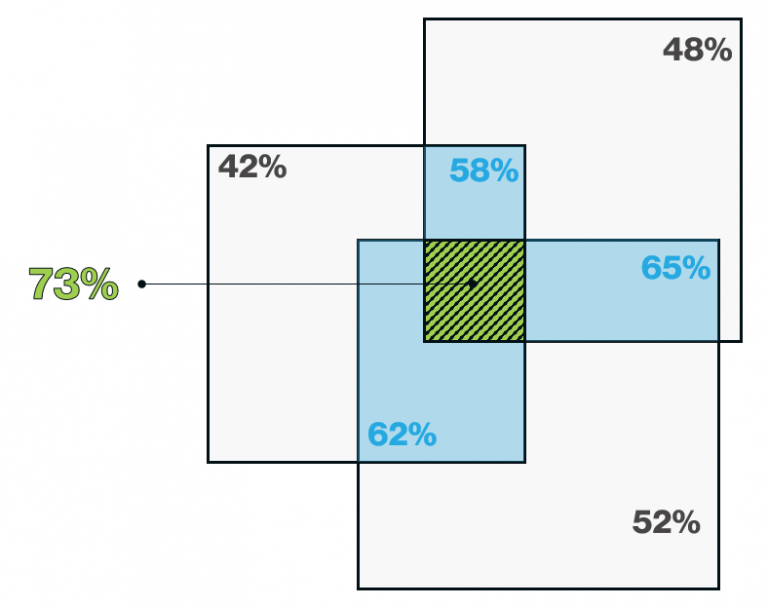

Our intelligent filter tools make it easy to exclude non-discretionary and insignificant trades. Our flags and ranks help you find alpha based on our comprehensive historic backtesting.

Timely Processing

Our analysts cover three time zones and process data within each region throughout local market hours. We aim to process trades within an hour of them being reported and usually exceed expectations. Our intra-day delivery options allow you to view trades during open local market hours.

Multiple Factors

We add multiple contextual factors with over 100 additional fields to complement the reported trade parameters:

- Personal details of the insider

- Position within the company

- Company and Listing Trade Metrics

- Analysis fields & flags

- Insider's age

- Evidence of wealth

- Historic trade performance, and more.

Seamless Delivery

As a part of our insider transactions quantitative data offering, we deliver a single complete file and consistently incorporate data from multiple sources (markets).