Our Signals service is at the core of what we do. As a specialist research provider, we monitor the high-quality transaction data produced by our analysts, based in three different time zones, in search of significant trade characteristics.

With around 3,000 transactions reported each day, most are non-discretionary and very few are likely to provide a meaningful indication of future share price movements. Those that do are hard to find but not uncommon.

We apply quantitative and qualitative methods in order to identify the most significant transactions. Our research team provides insights and commentary on trades that are most predictive of future share price performance.

Please do not hesitate to contact us

experienced research team

Experience, supported by rigorous historic data interrogation, gives us the know-how to identify the trades that count.

We begin by filtering transactions that do not meet our tried and tested criteria; this yields a shortlist of trades that do not conform to regular patterns.

We study whether these trades align with convictions made by insiders and try to ascertain whether they possess insight into the future share price of the stock they are trading.

Timely Processing

Our analysts cover three time zones and process data within each region throughout local market hours. We aim to process trades within an hour of them being reported and usually exceed expectations. Our intra-day delivery options allow you to view trades during open local market hours.

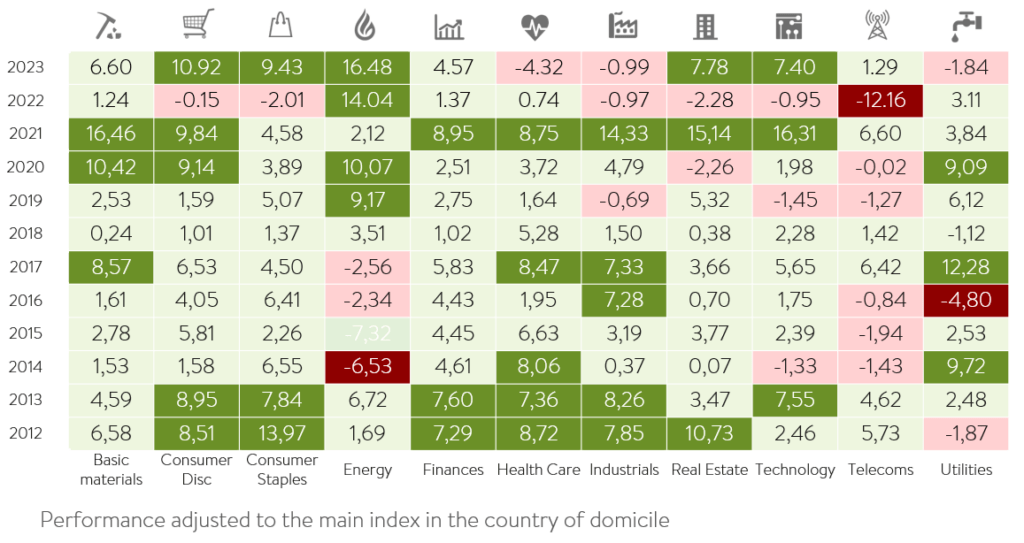

View our signals performance

Timely alerts

When it comes to data, we are more concerned with quality rather than quantity.

By customising delivery, in such a way as to suit the preferences and needs of the user, we can ensure that the frequency of alerts received provides our clients with the most pertinent of facts related to their investment process.

Desktop alerts draw attention to key trades and give users the ability to look behind the headline content with comprehensive filtering and display tools.

Seamless Delivery

As a part of our insider transactions quantit ative data offering, we deliver a single complete file and consistently incorporate data from multiple sources (markets).

Our Clientele

- Analysts and Fund Managers seeking to incorporate perspectives derived from Insider activities and signals into their investment process

- Buyside and Sellside analysts looking for market sentiment data

- Quants looking to enhance their systematic strategies with alternative data sources

- ESG specialists seeking to discover aspects of corporate governance

People

Head of Research

Quantitative Analyst

Quantitative Research Analyst

Quantitative Strategist

Senior Analyst

Institutions

Hedge Funds

Family Offices

Institutional Portfolio Managers

Institutional Investors

Assets Managers

Please do not hesitate to contact us